I am so happy to brag that our company Insurance Experts Agency, Inc. was able to help another client with their fire insurance claim through our insurance principal, FPG Insurance Co., Inc.

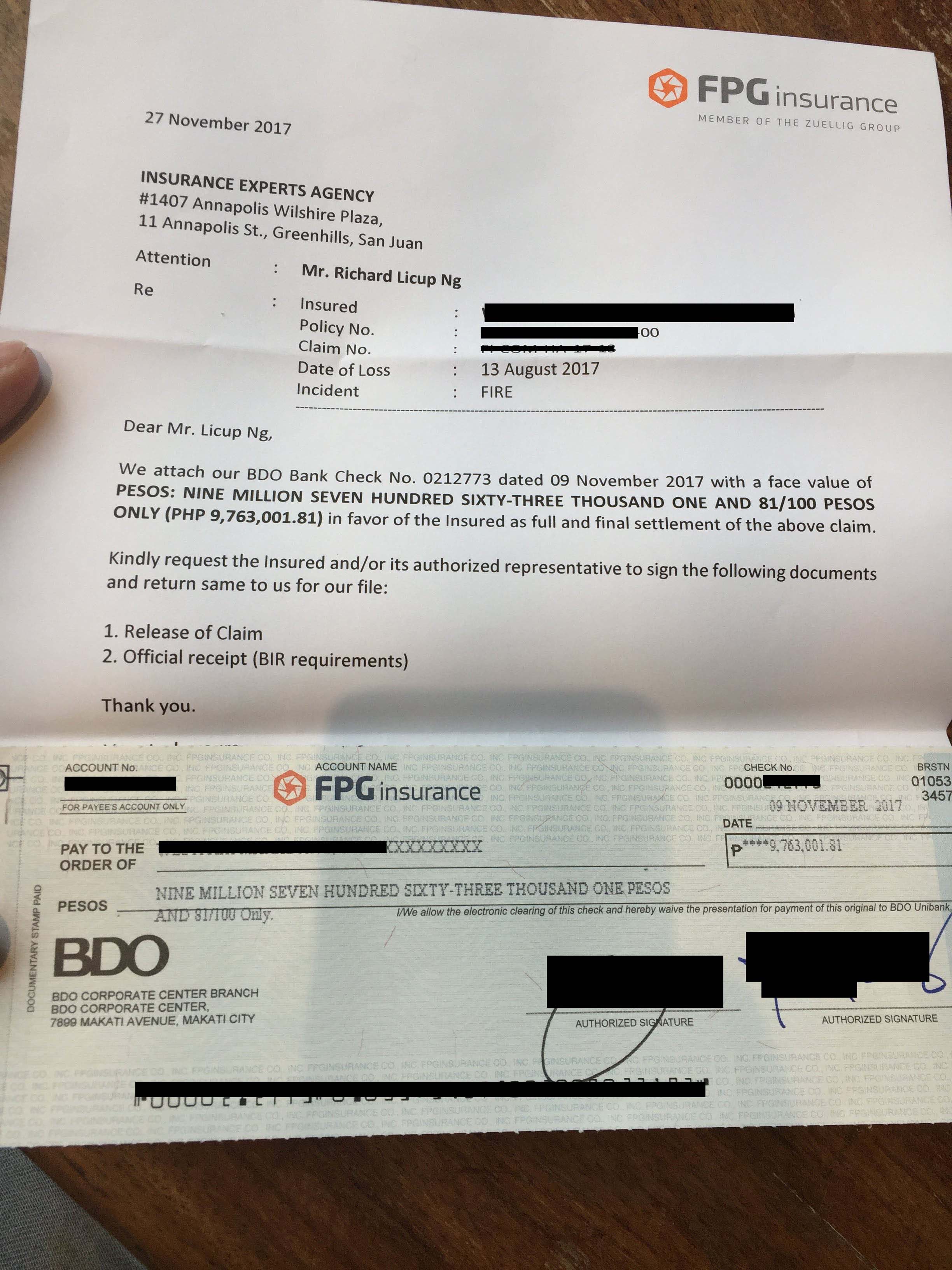

The loss was on August 13, 2017. Client reported the incident immediately. FPG assigned Senon Ajusters on the next day August 14, 2017. By August 22, pertinent documents were requested to the client for compliance. September 26, Senon received the documents from the client. By October 9, additional requirements were identified and requested. The next day client submitted the lacking documents. By October 30, we received the offer letter from FPG and forwarded immediately to the assured. By November 28, I accompanied my client to FPG head office in Zuellig Tower in Makati. Here’s another surprise, we arrived there by 10:45am, the claims officer upon seeing us, greeted us and rushed back to his post to get the check. Moments later, he handed the 10M pesos check without hesitation and just asked for the receiving copy. He was prepared!

This is so far the biggest claim check we had in Insurance Experts Agency, Inc.!

So what made this claim fast and hassle-free. As a licensed agent, i wanted to share the coverage of the policy.

This is a fire insurance policy with Allied Perils with 3 locations of risk. Warehouses 7, 10 and 12. With 10M coverage for each warehouses. Last August 13, Warehouse 7 got burned due to faulty electrical wiring, everything went into ashes.

Since we decided to breakdown the coverage to 10M per warehouse, this incident was considered total loss by the insurance company. The adjusters scrutinised everything including their profit margins, importation papers, number of stores, monthly sales, informations you wouldn’t normally reveal to someone else, but i asked our assured to trust the process and cooperate for the quick valuation of the claim. The obvious reason why the adjusters need to get those informations is for them to eliminate the criminal act of arson. The assured was hesitant at first to give their trade secrets and i kept on confiding to them that the informations will be kept for them alone, i assured them that i will not read nor look into their documents for their privacy’s sake. Thankfully, they listened and trusted the process. After that, the results came in quickly, the adjusters initially settled for the salvage items amounting to 236,000 pesos. These are the steel scrap seen on the video. Then a week later the entire check amounting to 9.7M.

Along the way, our client was anxious about the claim, they have lots of “what if” questions. And so they asked, What if we didn’t breakdown the policy to 10M each, we might be getting 30M instead?

I told them: “That’s always been the wrong perception of people about insurance, if that was the case, the insurance will not declare it as total loss, therefore a partial loss. In partial loss, the adjusters has to scrutinise not just warehouse 7 but all the other warehouses which includes all the documents pertains to it and if adjusters come up with a number more than 30M pesos, then “Average clause ” comes to play. Plus the fact that the other 2 warehouses are intact, meaning stocks come and go, it will really be difficult for the adjusters to get actual figures which means they might request you to stop operations until they are done with the investigation. And i told them that insurance has a computation for “Average Clause”

UNDER INSURANCE ( Partial Loss ) –

30,000,000 (Sum insured) / 60,000,000 (Actual sum) x 10,000,000(Actual Loss)Â = P 5,000,000 Claim Payable

That could be the outcome if we wrongly insured your property.I said. It was an awkward situation but i have to explain it and i have to deliver the message without prejudice. That has always been my value proposition to my clients, i want to build the integrity of the insurance, it is always been misinterpreted by many. After explaining, since the insurance is up for renewal, they wanted to insure at 30M per warehouse because of anxiety. So i gave proposals at 30M. The assured was not approving the proposal yet maybe because he was hesitant and wanted to wait for the claim check. After we forwarded the offer letter and analysed how it was computed, i advised the client not to increase the coverage. After explaining why, the assured agreed and had the policy renewed.

All is well that ends well. Our business is not really about selling insurance, its more of protecting your hard earned properties!

That is very commendable, Richard.

Please tell me why is vat factored into computation, by a loss adjuster in order to deduct it from the indemnity payable by the insurance company to an insured?

Hi Richard. I would like to avail your service in claiming my insurance for carnap case. The adjusters seems to be finding ways to stop me from claiming.

Hi John, Sorry wasnt able to see your comment right away. What is the status of your claim now? I am interested to look into your case. Please call us at 7245140 and richard@insuranceexperts.ph